Offline Events & Brand Campaigns (Sydney/Melbourne)

the Engine that Turns Buzz into Bookings, Visits & Sales

In Australia—especially across Sydney CBD, Pitt Street, Darling Harbour, ICC Sydney, Melbourne CBD, and Chadstone—offline events and brand campaigns are no longer "nice PR moments." For local venues, medspas/clinics, and showrooms/reno brands, they're the most predictable way to turn content into bookings and footfall into first-party data.

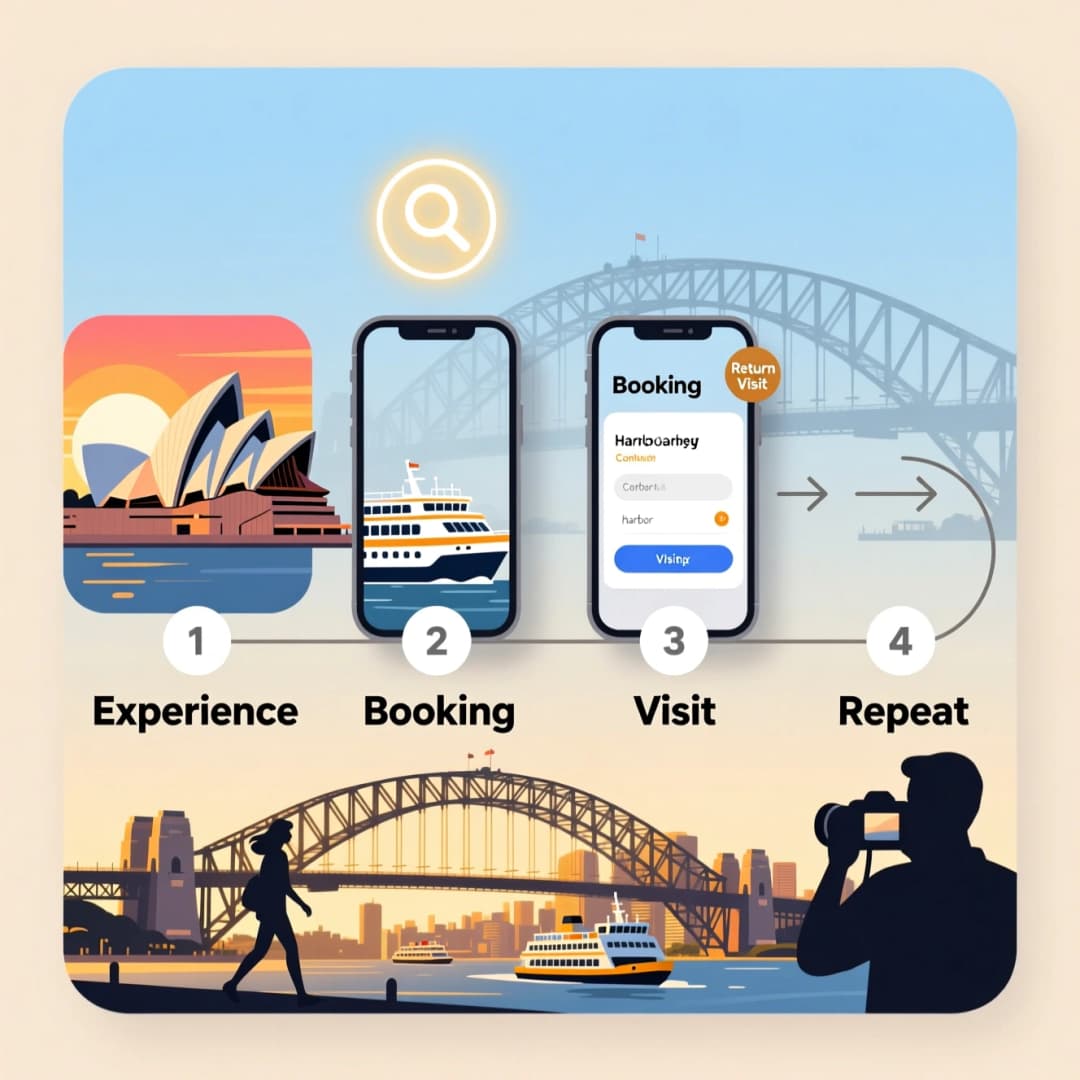

When digital costs rise and reach gets volatile, experiential marketing becomes a steady, third growth curve: experience → booking/lead capture → visit/sale → repeat/loyalty. At Shiny, we don't "post more"; we run a Creator-Led Booking Engine and install a conversion stack so your event is measurable from hour one: landing page + OpenTable/Fresha integration + GA4 & pixels + micro-creators + remarketing.

Why offline experiences matter more in 2025

(the business logic of Event Marketing in Sydney)

1. Memorable attention

Immersive space, hands-on trials, and designed photo moments turn "I saw it" into "I remember it—and share it."

2. Verifiable conversion

Put booking/forms into the physical flow (entry, interaction, exit). Day-of data shows reservation clicks, consult requests, and form submits—not just foot traffic.

3. A content mine you own

One event yields 3–6 months of authentic UGC and short-form video for IG/TikTok/Xiaohongshu, lowering future content and media CPA.

4. City-level tailwinds

Festivals, trade shows, weekend precinct programs and the night-time economy funnel intent-rich crowds into bookable demand.

5. Bilingual reach without a split funnel

English + Chinese assets can widen reach across communities—as long as the booking path remains a single, unified flow.

Australian market signals: from "city buzz" to executable opportunities

• Precinct dynamics

Pitt Street Mall, Town Hall–QVB, Darling Harbour–Barangaroo and Melbourne CBD/Chadstone routinely spike UGC and dwell time on weekends and during festivals.

• Conferences & trade

ICC Sydney drives stable flows for pop-ups, demos, and trial-to-book installations.

• Retail & dining

Flagship refreshes, seasonal menus, street-level F&B activations, and night-time economy programming correlate with reservation growth.

• Health & community

Running/cycling/yoga communities and women's safety narratives continue to anchor resonant brand activation stories (e.g., night runs, guided routes, "city guardianship").

Methodology: the four growth flywheels & the 3-box dashboard

3.1 The four flywheels of Brand Activation Sydney

• Attention

Immersive build + city moments (festival/trade/sport) → built-in reach and FOMO

• Trust

Real touch/try + KOC/KOL/local media → removes the "last-inch" anxiety before purchase

• Data

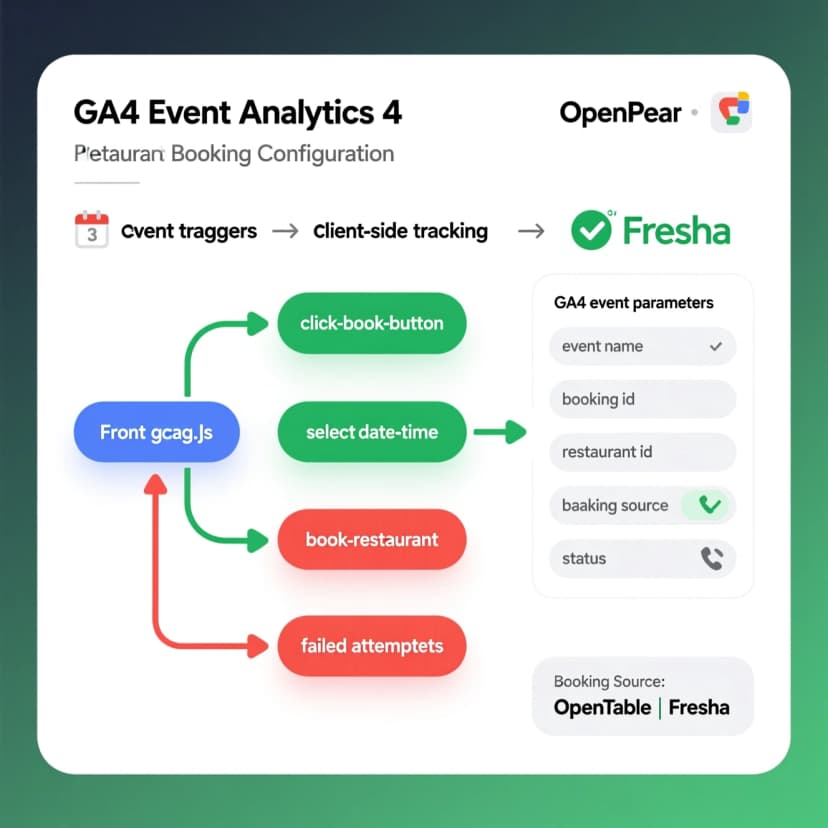

Landing page + OpenTable/Fresha/Calendly + GA4/pixels → footfall → leads → members

• Content

Events become a UGC mine feeding IG/TikTok/Xiaohongshu/LinkedIn for months

Essence: design experience nodes that are also content nodes and conversion nodes—not an after-the-fact ROI hunt.

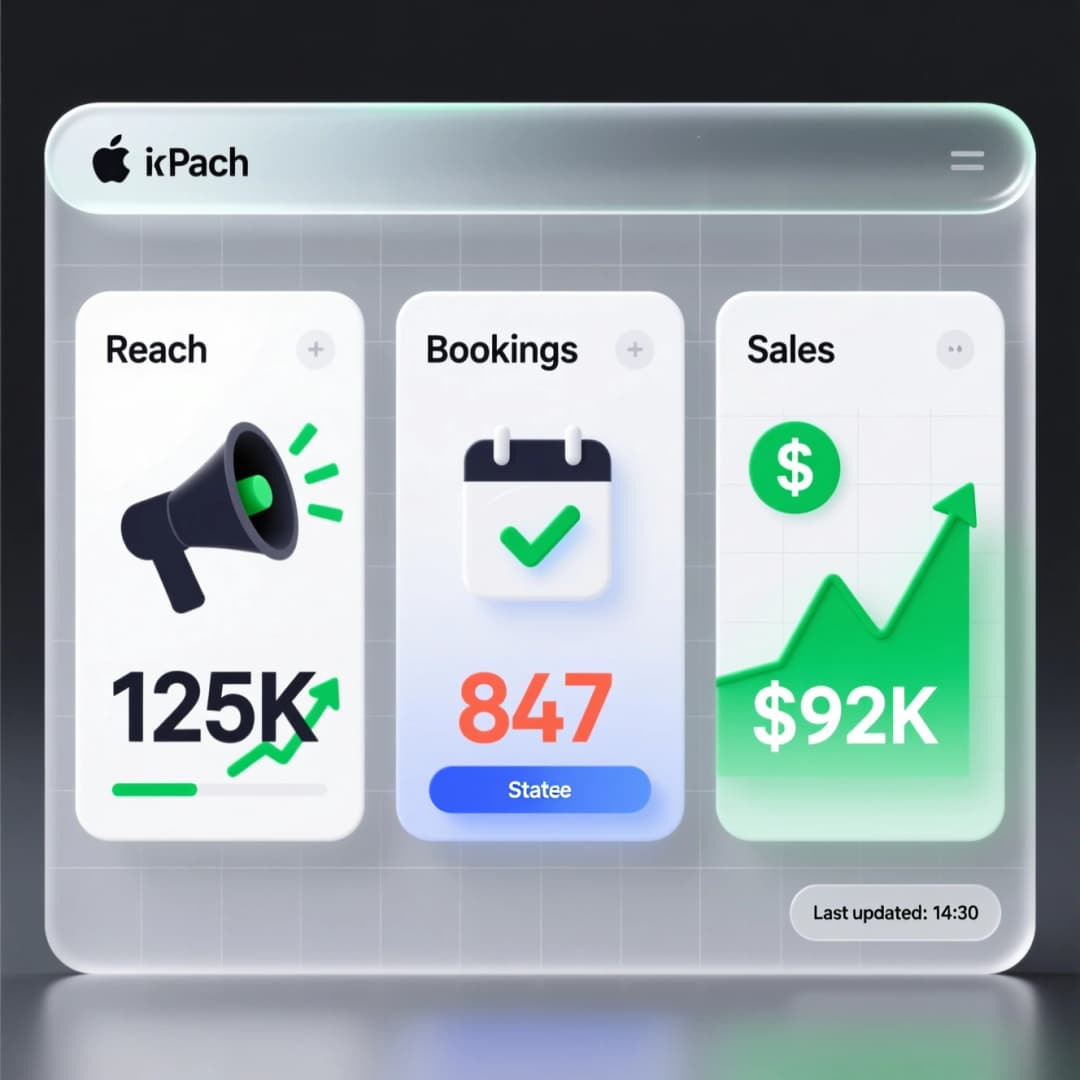

3.2 The 3-box dashboard (one source of truth)

Keep the framework simple and consistent across every event so you can compound learnings and forecast ROI.

Use-cases: turning macro insight into concrete plays

4.1 Grand Opening Activation (Sydney): convert day-one buzz into trackable bookings

Core insight

A grand opening compresses awareness → trial → first-party capture into one day. By T-14, ship the conversion stack (landing page + OpenTable/Fresha + GA4/pixels) and schedule micro-creator drop-ins. On site, use QR mission cards to turn queues and photo-ops into reservation clicks, consult requests, and CRM IDs.

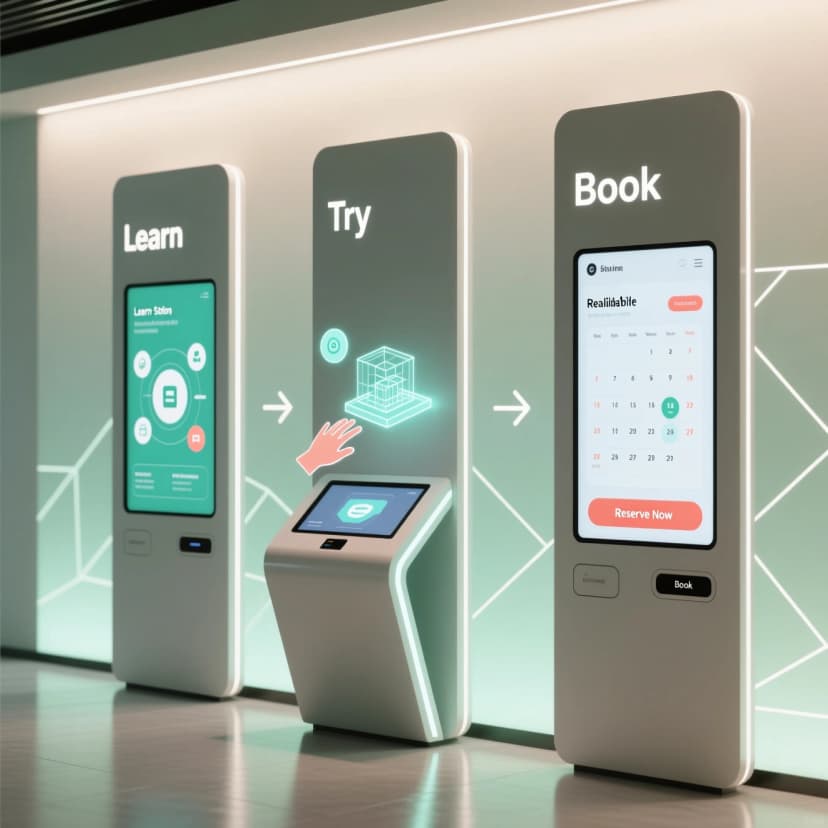

Entrance → Experience → Offer → Booking (recommended flow)

- • Entrance: hero KV + brand promise; primary QR goes straight to booking/reservations

- • Experience: try-me demos, before/after showcases; shootable and shareable

- • Offer: opening-day exclusives (first-100 gifts, day-one bundles, bring-a-friend perks)

- • Booking: OpenTable/Calendly/Fresha pinned at the top, short links/short codes, staff assistance

Indicative 14-day bands (Sydney CBD)

Copy you can lift

- • We turn grand opening buzz into bookings.

- • Grand Opening Activation Sydney — a creator-led booking engine with measurable KPIs.

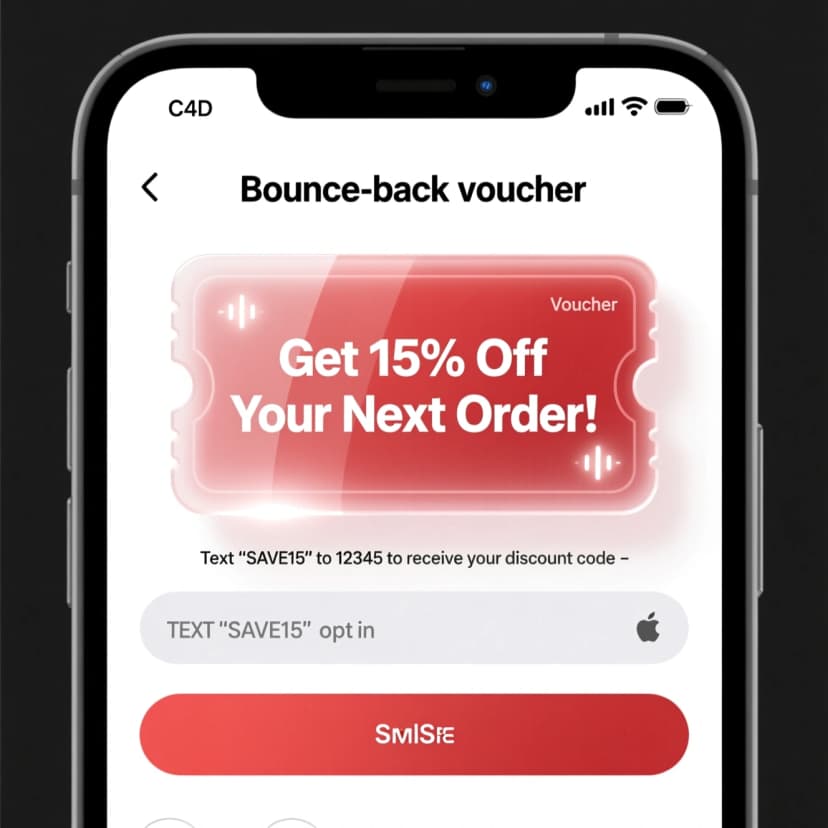

4.2 Anniversary Campaign: reactivation, AOV uplift, wider circles

Core insight

An anniversary is ideal for reactivating lapsed customers and lifting AOV through bundles/memberships. Shift the story from "celebrating us" to "promising the next year" (member benefits, experiences, service upgrades).

Suggested components

- • VIP Night (top-10% customers + media/KOL/KOC): community and exclusivity

- • Give-back mechanic: donation per booking/sale with a local partner

- • Bounce-back voucher: day-of booking/purchase unlocks next-visit credit

- • 90-day reactivation: segmented SMS/email to wake lapsed users

Indicative bands

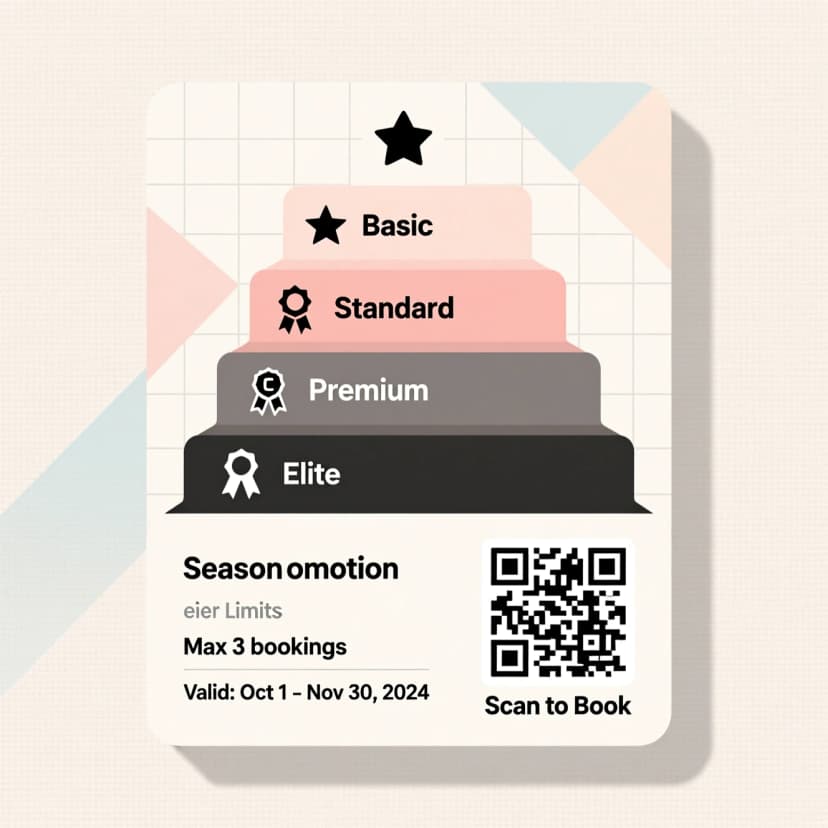

4.3 Promotional Campaigns (seasonal): structured value, not blunt discounts

Core insight

Seasonal peaks (Lunar New Year, Mother's Day, EOFY, Black Friday, Christmas) reward offer architecture + remarketing more than one-size-fits-all discounts.

Four structures (pick 2–3 to stack)

- 1. Tiered rewards — e.g., spend A$120 → A$20 future credit

- 2. Bundles — service + add-on / duo menu / starter + advanced

- 3. Limited drops — weekend chef's table / limited-run skincare kits

- 4. Community pass — bring-a-friend codes; group reservation perks

Tracking that holds up

- • Channel- and creator-specific UTMs/codes; add a "Booked via campaign" field to forms

- • 7-day/30-day payback checkpoints and remarketing audiences ready from T-14

Creative & space design: default to "shootable, postable, bookable"

• Unified identity across OOH/print/digital

(KV, color/typography, subtitle style)

• Three-part narrative for all assets and creators

pain → solution → perk/booking

• Shootable set-pieces

photo wall, light play, logo frames; three-step trial for hero benefits

• Consent by default

registration copy/on-site signage includes content reuse permission (with privacy language)

• Bilingual clarity

English/Chinese assets and wayfinding, one unified booking path

Data & reporting: measure every Event Marketing play the same way

• Event mapping

click_book, submit_form, reservation_confirmed, call_request

• Views

channel × creator × event-day for bookings/leads and visits/sales/AOV

• Asset archive

tag day-of capture for Reels/TikTok/Xiaohongshu/testimonials; re-edit into remarketing packs

• Cadence

4-hour/24-hour checks; T+1 publish the 3-box report and next-month plan

Execution cadence (2–8 weeks): put complexity into the timeline

T-8 → T-4

- • diagnostic & KPI lock

- • venue/permits/insurance

- • vendors & staffing (MC/photography/security/volunteers)

T-3

- • landing page + booking integration (OpenTable/Fresha/Calendly)

- • GA4/pixels

- • asset list & design

T-2

- • pre-heat ads & media list

- • micro-creator sourcing/briefs/schedule

- • flow simulation & safety plan

T-0

- • build & QA → go-live

- • 4h/24h KPI checks

- • on-site content capture

T+1

- • 3-box report + asset archive

- • remarketing & second-wave conversions

FAQ (focused on Event Marketing/Brand Activation in Sydney)

Q1. Should we pay for "big-name" creators?

Prioritise a micro-creator grid (staggered time slots and sub-communities) for measurable bookings; use headliners to cap reach, not to carry conversion.

Q2. Won't bilingual campaigns complicate the funnel?

Run bilingual assets, single path. English and Chinese broaden reach, but all bookings/forms live on one URL for clean data.

Q3. How should we set the budget?

Backsolve from KPI bands and payback: lock targets for bookings/visits/sales, then allocate to creative/production/traffic/on-site/data. Review with the 3-box dashboard every time.

Q4. What's non-negotiable on safety and compliance?

Crowd flow, insurance and permits. Treat capacity modelling as a creative constraint—design near-capacity flows before you design the photowall.

Closing note: make Event Marketing a predictable operating asset

The value of offline events and brand campaigns isn't the one-off spectacle; it's the repeatable recipe. When experience × booking × data × content run as a stable loop, your brand in Sydney/Melbourne earns predictable bookings and compounding revenue—month after month.